Learn the key aspects of Banking as a Service (BaaS) for software platforms.

Discover the importance of integrating financial services into your product, how to evaluate BaaS solutions, and how Stripe can assist you.

Determining whether a company is considered a Fintech is no longer straightforward. With the proliferation of Banking as a Service (BaaS) tools, it's much easier for platforms to directly integrate financial services (such as business cards, monetary accounts, and access to loans) into their products. Thanks to these customized financial services, platforms become an integrated solution that allows customers to manage all aspects of their business in one place.

This guide addresses the basics of BaaS for software platforms in the United States (the financial products and services explained here work differently in Europe and the Asia-Pacific region). You will discover why you should integrate financial services into your product, how to evaluate BaaS solutions, and how Polipay can assist you.

This guide focuses on financial services available to platforms through BaaS, beyond payment processing. If you are interested in incorporating online payments, you can refer to ourintroduction to online payment collection and learn how tomonetize payments..

A Banking as a Service (BaaS) provider facilitates any business, from Fintech startups to established platforms, to integrate financial services that banks typically offer (such as monetary accounts, cards, and loans) directly into their existing software. BaaS providers typically work directly with banks to provide the underlying service, and then platforms can use BaaS APIs to enable customers to retain funds, pay bills, manage cash flows, and access financing, all while working directly with the platform they already know and trust.

BaaS providers are crucial for a variety of businesses, from neobanks to marketplaces. When a software platform uses a BaaS provider, this is often referred to as "integrated financial service," as the platform incorporates these services as part of its core software. Nowadays, many platforms already offer a version of integrated financial services by providing payment processing, access to ACH, or bank transfers through a payment service provider. A BaaS provider allows platforms to add even more financial services to their product.

A decade ago, almost all platforms could be considered "SaaS 1.0," as they only offered customized software services (such as scheduling appointments for beauty salons) and generated monthly recurring revenue from customer subscriptions. Nowadays, most platforms are considered part of the "SaaS 2.0" generation, facilitating online payments for their customers, marking their first step in integrating financial tools into their product. This feature has become a fundamental requirement for platforms; without the incorporation of online payments, they find it much more challenging to compete in the market. Facilitating online payments also helps SaaS 2.0 platforms generate more revenue. In addition to charging for monthly subscriptions, they can also charge customers for access to payment processing.

Now, thanks to the rise of Banking as a Service solutions, platforms are beginning to evolve once again towards "SaaS 3.0," offering additional integrated finance features (such as loans, accounts, and cards) to customers beyond payments.

BaaS is a type of financial technology that helps software platforms access banking functions traditionally offered only by authorized banks. In this way, companies can conveniently offer customized banking services within their platform and prioritize a better overall experience for their customers.

Here's a specific example of how BaaS works for platforms: imagine a platform that provides appointment scheduling software and payment processing for beauty salons and hairdressers (let's call it "The Brush").

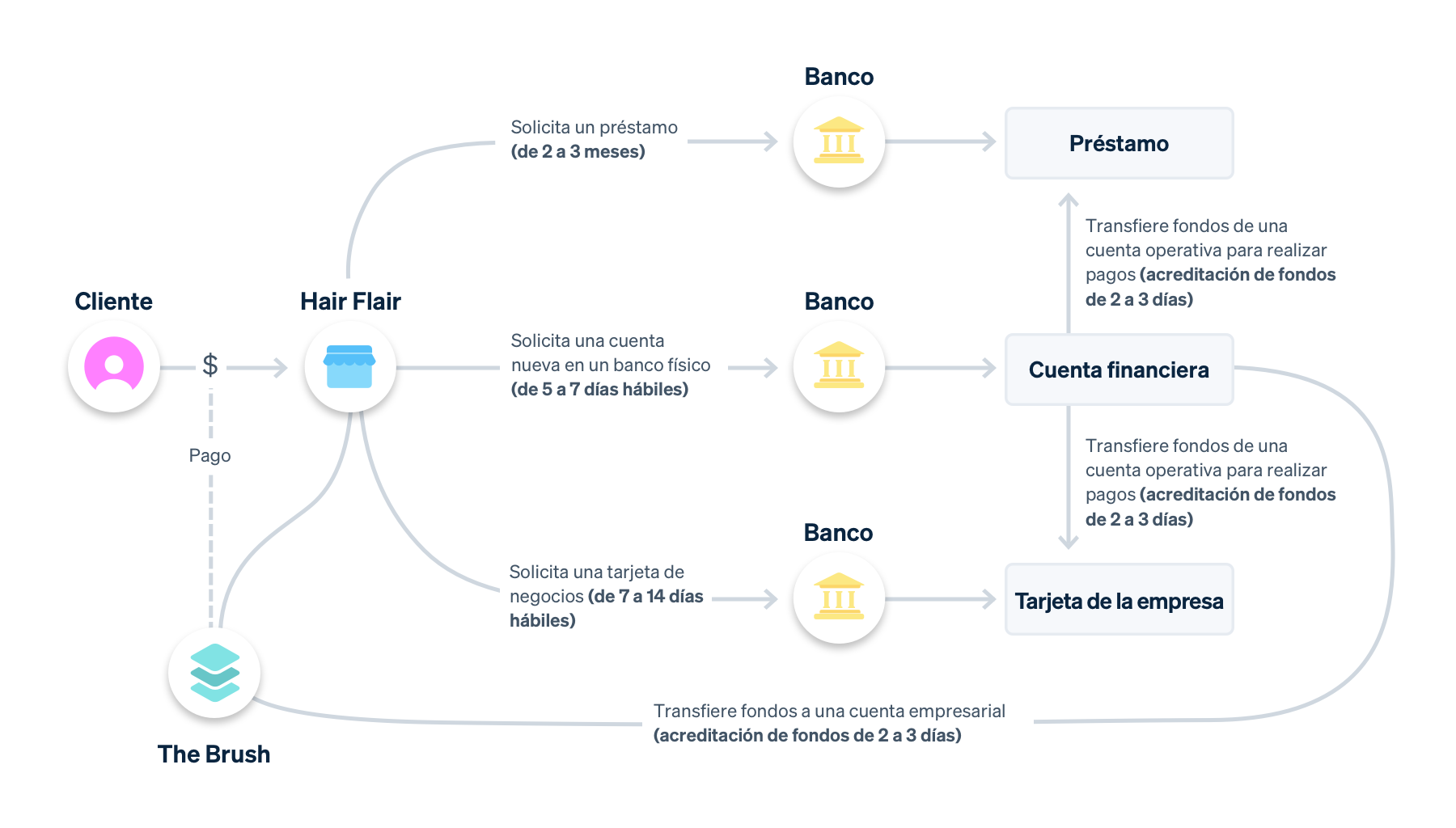

Let's use Hair Flair as an example, one of The Brush's clients. Hair Flair has been using The Brush for three years to manage appointments and process payments from clients. When Hair Flair wants additional financial services to manage its business, it has two options: 1) work directly with banks or 2) access financial services through The Brush.

Hair Flair has just opened a second location, and the salon owners first need a place to store funds used to pay their stylists. To open a bank account, they must go to a financial institution (such as a local physical bank) and share their business information.

If Hair Flair does not get approval for a business account, they will have to open a personal bank account, blending their personal and business finances. In this case, they create the account at the physical bank, but now they need to manage the fund flow, move the money from their earnings in The Brush to their new account, and constantly wait two to three business days to cash that money before paying their employees.

According to aStripe survey, 55% of businesses have to visit a local branch in person, and 23% have to send a fax to open a bank account.

Beauty salon owners also need capital to invest in marketing and renovations. They could apply for a loan from the same financial institution where they opened their bank account, but ultimately find a loan with a lower interest rate at another local bank. They apply for the loan in person and complete an extensive application form with their business information. Unfortunately, since the bank is not familiar with Hair Flair or the typical cash flow expected from beauty salons, Hair Flair does not get approval for the loan. They apply in two more banks and receive approval from one of them after a couple of months.

Only 48 % of small businesses have access to all the financing they need.

Additionally, Hair Flair has many expenses at its new location. Instead of using a personal card, they decide to apply for a business credit card to purchase new equipment and supplies.

They look for a card with a low-interest rate and manage to obtain it from a different bank than the one where they applied for the loan and opened an account. They once again share all their information and now need to figure out how to manage the money on the card with funds from The Brush or their financial account.

In addition to opening accounts at different banks, Hair Flair owners spend time every week reconciling finances between these accounts to track their money, pay taxes, and avoid bounced checks. This also means that a significant portion of their earnings may be tied up in transfers before they can spend it.

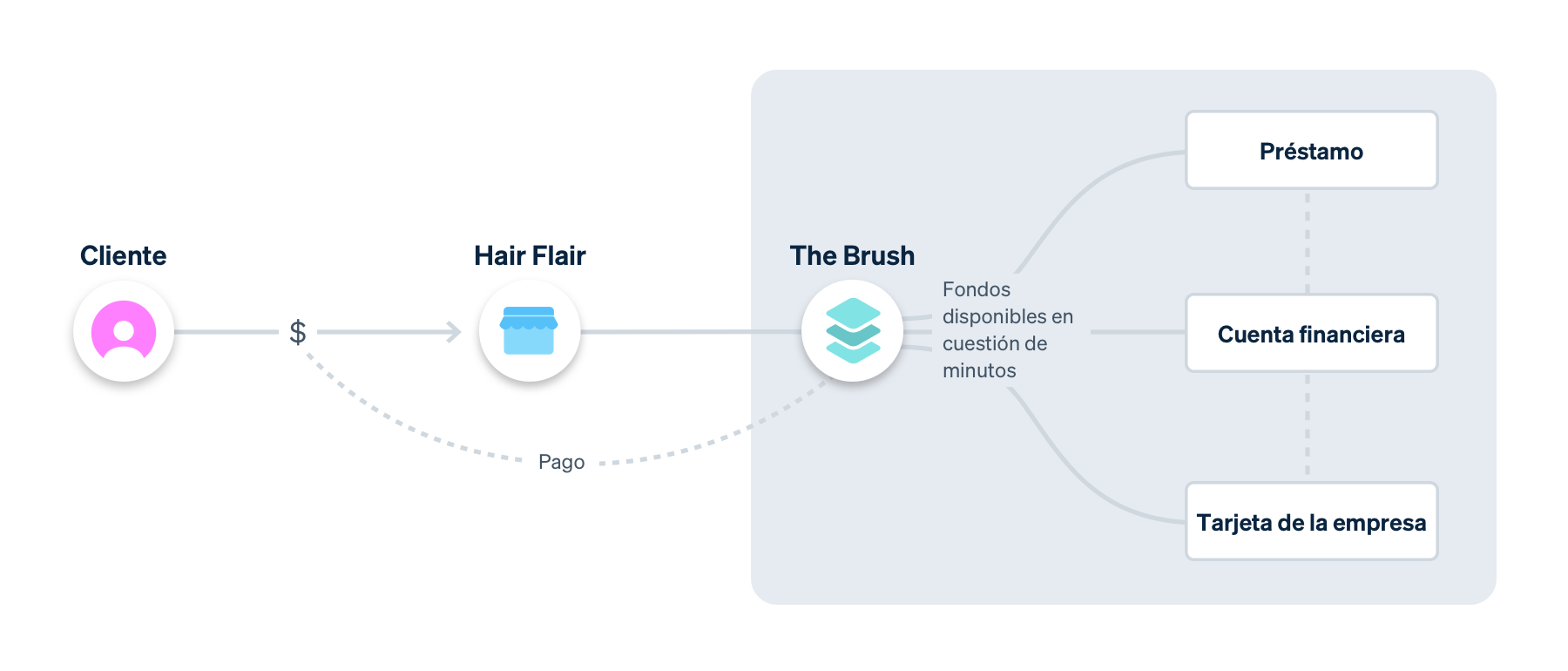

The Brush, which started as appointment scheduling software for beauty salons, now allows customers to access banking features, such as processing payments, accessing capital, obtaining business cards, and opening financial accounts, all in one place. These benefits are added to the core scheduling and appointment booking functions.

Because Hair Flair processes all customer payments on The Brush, this platform fully understands the salon's financial history. It also inherently knows the sector's needs and the typical capital requirements. This time, when Hair Flair applies for a loan, The Brush's banking partner determines Hair Flair's eligibility based on its payment volume and platform history, approving the loan the next day. The funds appear in Hair Flair's financial account through The Brush, without the need for additional documentation.

Additionally, Hair Flair can easily invest that additional capital in the business card it has through The Brush. The card is linked to its financial account and can access all funds (earned and borrowed) in one place. The funds are immediately available, so Hair Flair can use the card as soon as customers pay for their services. They can use the card to pay for supplies and company expenses and, if the platform decides to offer it, can earn rewards as they spend money (e.g., cashback on salon-related purchases or receiving a free month of The Brush).

Lastly, Hair Flair owners save a lot of time each month on financial reconciliation. By having all financial activity (customer payments, loans, and business expenses) in one place on The Brush platform, owners can access up-to-date financial reports at any time without moving between different systems and tools. They also don't have to worry about remembering to make a transfer or pay a loan. The Brush is the comprehensive platform where Hair Flair manages all aspects of its business.

Shopify is a leading international commerce company that provides trusted tools to create, grow, promote, and manage a retail business of any size. Financial operations are a crucial part of running a business, and current financial services are not designed to meet the needs of independent business owners. Shopify Balance offers Shopify merchants a fast, simple, and integrated way to manage funds, pay bills, and track expenses. This allows them to more easily access financial products and better control their finances.

With integrated financial services, platforms like The Brush can address basic business challenges for clients like Hair Flair, creating an overall better experience. However, the integration of financial services not only provides customers with a better experience but also offers tangible benefits to the platforms.

- Increase Customer Lifetime Value (LTV): There are two main ways to increase LTV: encourage customers to use your product more or get them to use it for a longer period. Supporting financial services can help with both strategies by creating a software ecosystem for customers that offers a variety of useful functions in one place. For example, more than 70% of Stripe customers who accept a loan through Stripe Capital accept a second loan through this product, allowing Stripe Capital to invest more money in customer acquisition for those applying for a loan for the first time.

- Reduce Churn Rate: Processing payments, having an account, using debit or credit cards, and accessing capital are essential parts of managing a business. By integrating these financial services into products, you provide your customers with a significant reason to continue using your software, thereby reducing the likelihood of customer churn.

- Create New Revenue Streams: Integrated finances can become a significant part of platform revenues. In fact, it is estimated that SaaS companies can increase their revenues from 2 to 5 timesby integrating financial services. Depending on the financial services you enableyou can make money through interchange fees (a fee charged for card transactions), by charging a payment processing fee, or by assisting banking partners in providing financial services to your customers.

- Enhance Customer Experience and Overall Satisfaction: Integrating financial services into software saves time, energy, and resources for your customers. Instead of switching between different systems and dealing with complex banking requirements, they can perform all operations in one place. This fosters customer loyalty, resulting in more satisfied customers who are more likely to continue using your product and recommend it to others.

Before adding more financial services to your platform, you must ensure you know which services make the most sense to offer to your customers. There is no one-size-fits-all approach. Most companies start with payment integration, but the other services they offer through a BaaS provider vary. For example, Lightspeed Capital, a large-scale commerce platform, began with integrated in-person and online payments and, two years later, started providing loans to its customers. We suggest conducting user research to understand your customers' pain points and determining which financial services best meet their needs. (If you are a platform already using Stripe or Polipay, contact baas@polipay.mx or your Polipay contact to see how we can assist you).

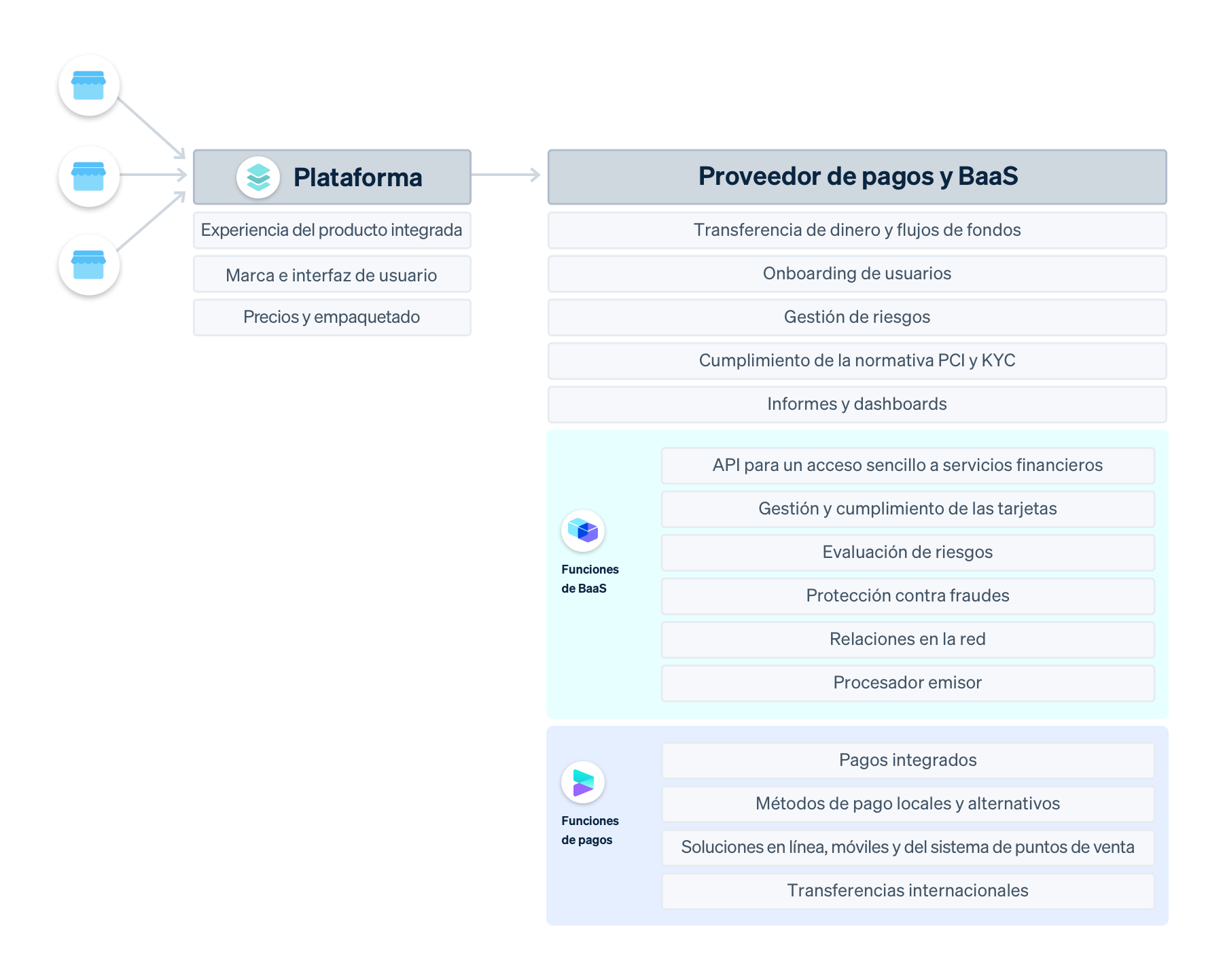

Here are the five key requirements you should look for in a BaaS provider:

1. Includes Payment Services

The simplest option is to use a solution that offers both payment and BaaS services. This significantly reduces the complexity needed to market and expand your offerings, lowering internal costs. Since everything is in one system, you don't have to worry about managing funds complexly, and your customers only need to provide their information once during onboarding to access a variety of financial services. This allows you to keep focusing on your core product while the provider takes care of addressing your customers' financial challenges.

This option also provides the greatest value to your customers. If you access your payment service, financial accounts, and cards through a single provider, you can pay individual entrepreneurs or contractors on your platform using money customers earn from sales. The individual entrepreneur or contractor would have access to these funds within seconds through a financial account and a card, and you would have no need for additional working capital.

2. Accepts Various Financial Services

When you start offering integrated financial services to your customers for the first time, you can begin with a single service, such as cards. As demand grows, you may want to offer access to additional services, such as financial accounts. These different financial services are related to money management (accessing it, storing it, spending it, and transferring it), so the systems should be able to communicate with each other and send important customer information. Instead of expanding your integrated financial services offerings through multiple specific solutions, look for a single system that can support a variety of financial services as you expand.

3. Provides Rapid Marketing and Iteration Capability

You may want to test product-market fit to check if there is demand for the financial services you want to integrate into your product. Based on how customers react, you'll want to be able to quickly adjust or expand it.

For example, imagine you add payments to the core solution, allowing customers to accept money on the platform. You observe great interest, but customers tell you they also want to be able to easily pay business expenses with their earnings, so you'll want to offer them a card. The best BaaS solutions should allow you to quickly add different capabilities and test them before rolling them out widely.

4. Easy to Integrate

The best BaaS providers make getting started as easy as possible. While integration will require some time, you should be able to access simple developer APIs and leverage a ready-to-use financial infrastructure. This way, you can focus on how your core business and integrated financial services work together, rather than developing banking infrastructure from scratch on your own.

5. Simplifies Regulation and Compliance Management

Services offered through BaaS providers are part of a regulated sector, resulting in a long list of regulatory and compliance requirements that you must manage and maintain. For example, offering minor expense cards for employees involves managing user verification, ensuring compliance with PCI regulations, understanding KYC requirements, and implementing measures to reduce fraud.

The BaaS provider should help you manage regulatory and compliance requirements significantly on your behalf, minimizing the amount of internal resources you need to maintain them on your own. It's especially helpful to consider this during onboarding. Ideally, the provider should assist with initial requirements, so customers only need to enter their information once when joining the platform for the first time, regardless of how many financial services they access.

Polipay is simple and flexible technological infrastructure that platforms can use to develop and launch their scalable and comprehensive functionalities for integrated financial services, whether it's payments, loans, cards, or replacements for bank accounts. Polipay's Banking as a Service (BaaS) APIs, along with our robust payment solution, enable companies, from fintech startups to established platforms, to integrate financial services directly into their existing software. Companies collaborate with Polipay to solve critical customer issues and generate additional revenue streams for their businesses.

All our products offer APIs that are essential components of the platforms and can be combined in different ways, depending on the needs of your customers and what makes sense for each business.

Payment Solution: Allows you to integrate payments to various parties and offer a variety of financial services, such as collecting payments from customers and making transfers to third parties. Platforms earn revenue by charging fees for the services they provide.

Commercial Financing: Enables quick and flexible financing to help your customers expand their business. Many small businesses struggle to obtain competitive loans, especially if risk assessment is challenging. Polipay removes this difficulty through a comprehensive loan program through a single integration.

Business Card: Allows you to create and issue physical and virtual cards instantly with your brand's image. Customers use the cards to make purchases for their business and have faster access to funds earned through sales. This allows you to understand how customers spend their funds while Polipay takes care of card production, manages logistics, and sends the cards. Platforms earn a share of the interchange fee charged each time a card is used.

Bank Account Replacement: Polipay's APIs create suitable accounts for customers, send domestic bank transfers, and support check deposits (coming soon). Polipay manages initial negotiations with a network of banks, integrates KYC into your product so you don't have to build an expensive KYC program, and provides guidance on remaining compliance requirements. Most platforms develop Polipay and Polimentes together to offer customers a way to store, spend, and manage money.

Contact our team for more information on how your platform can use Polipay to generate loans, issue cards, or create financial accounts.

MasterCard and Visa® commercial credit cards are issued by Polipay and FIS.

Polipay Cost Center is provided by STP, a licensed money transfer entity with funds stored at BANXICO.

Capital loans are issued by Becm Servicios de Occidente, an activities company. All loans are subject to credit approval.

Glosario de Pagos

Este glosario define los términos más comunes en el sector de los pagos.

Adquirente

También denominado banco adquirente, un adquirente es un banco o una institución financiera que procesa los pagos con tarjeta de crédito o débito en nombre del comerciante y los envía mediante las redes de tarjeta al banco emisor.

Transferencias bancarias

Pueden referirse al débito a cuenta, en el que recopilas la información bancaria de los clientes y extraes fondos de sus cuentas, o a una transferencia de crédito, en la que te vinculas a las cuentas bancarias de los clientes y ellos te envían dinero.

Titular de tarjeta

La persona que posee una tarjeta de crédito o débito.

Redes de tarjetas

Procesan transacciones entre comerciantes y emisores, y controlan dónde se pueden aceptar tarjetas de crédito. También controlan los costos de las redes. Algunos ejemplos incluyen Visa, Mastercard, Discover y American Express.

Contracargo

También conocido como disputa, un contracargo se produce cuando los titulares de tarjetas cuestionan un pago ante el emisor de la tarjeta. Durante el proceso de contracargo, el comerciante debe demostrar que la persona que realizó la compra es el titular de la tarjeta y autorizó la transacción.

Comisiones por contracargos

Costo en el que incurre el comerciante cuando el banco adquirente revierte un pago con tarjeta.

Cartera digital

Permite que los clientes paguen por productos o servicios de manera electrónica al vincular una tarjeta o cuenta bancaria, o al almacenar el valor monetario directamente en la aplicación. Algunos ejemplos son Apple Pay, Google Pay, Alipay y WeChat.

Disputas

Consulta la definición de «Contracargo».

Sistema cuatripartito o de cuatro partes

Las cuatro partes que componen el procesamiento de pagos son: el titular de la tarjeta, el comerciante, el adquirente y el banco emisor.

Fraude

Toda transacción falsa o ilegal. Suele suceder cuando alguien roba un número de tarjeta o los datos de una cuenta corriente, y usa esa información para realizar una transacción no autorizada.

Intercambio

Comisión que se paga al banco emisor por procesar un pago con tarjeta.

Banco emisor

El banco que emite tarjetas de crédito y débito para los consumidores.

Código de categoría de comerciante (MCC)

Número de cuatro dígitos que se utiliza para clasificar una empresa por el tipo de bienes o servicios que ofrece.

Aceptación en la red

Porcentaje de transacciones que acepta o rechaza el banco emisor. El rechazo puede deberse a credenciales desactualizadas, sospecha de fraude o fondos insuficientes.

Costos de red

El total de las comisiones interbancarias y de las redes de tarjeta.

Facilitador de pago

Anteriormente, para agregar funciones de pago era necesario que una plataforma o marketplace se registrara y mantuviera el estado de facilitador de pago ante las redes de tarjeta, ya que se consideraba que controlaba el flujo de fondos entre compradores y vendedores. Hoy en día, es fácil agregar la funcionalidad de pagos que requieren la mayoría de las plataformas y marketplaces sin convertirse en un facilitador de pago.

Pasarela de pagos

Software que cifra la información de las tarjetas de crédito en el servidor del comerciante y la envía a la entidad adquirente. Los servicios de pasarela y los adquirentes suelen ser la misma entidad.

Método de pago

La forma en que un consumidor decide pagar por bienes o servicios. Los métodos de pago incluyen transferencias bancarias, tarjetas de crédito o débito y carteras digitales.

Procesador de pagos

Facilita la transacción con tarjeta de crédito al enviar la información de pago entre el comerciante, el banco emisor y la entidad adquirente. El procesador de pagos suele obtener los detalles del pago de una pasarela de pagos.

Estándares de seguridad de datos de la normativa PCI (PCI DSS)

Estándar de seguridad de la información que se aplica a todas las entidades que almacenan, procesan o envían datos de titulares de tarjetas o datos confidenciales de autenticación.

Comisiones de las redes de tarjeta

Comisiones que cobra la red de tarjeta. Una sola transacción puede incluir varias comisiones, como las de autorización o servicio.

¿Ready to Get Started? Contact us or create an account.

Create an account and start accepting payments, without the need for contracts or bank details. You can also contact us to design a customized package for your business.